Getting My Federated Funding Partners Legit To Work

Table of ContentsFederated Funding Partners Reviews for DummiesThe Main Principles Of Federated Funding Partners Getting My Federated Funding Partners To WorkSome Of Federated Funding Partners ReviewsMore About Federated Funding Partners Reviews

When you are in a position to do so, an option to decrease that expense is to utilize the cash you will be saving to pay added on your loan monthly and pay the loan off quicker, consequently conserving some cash on interest over the training course of the car loan.

Closing your credit history cards will trigger your credit rating use rate to enhance, which can harm credit rating. federated funding partners. The lender might likewise add a declaration to the account that shows the payments are being handled by a financial debt combination firm. This declaration might be seen negatively by loan providers who manually review your record.

The 9-Second Trick For Federated Funding Partners Bbb

Although the debt consolidation business will certainly be making repayments on your behalf, you will still be in charge of ensuring those repayments are made to your financial institutions on schedule. If the debt loan consolidation firm stops working to make a repayment in a timely manner, the late payment will certainly be mirrored on your credit rating record.

Before becoming part of any kind of financial obligation loan consolidation strategy, research the deal to ensure that the business is trustworthy which you fully recognize the terms and effects of the program. Thanks for asking,.

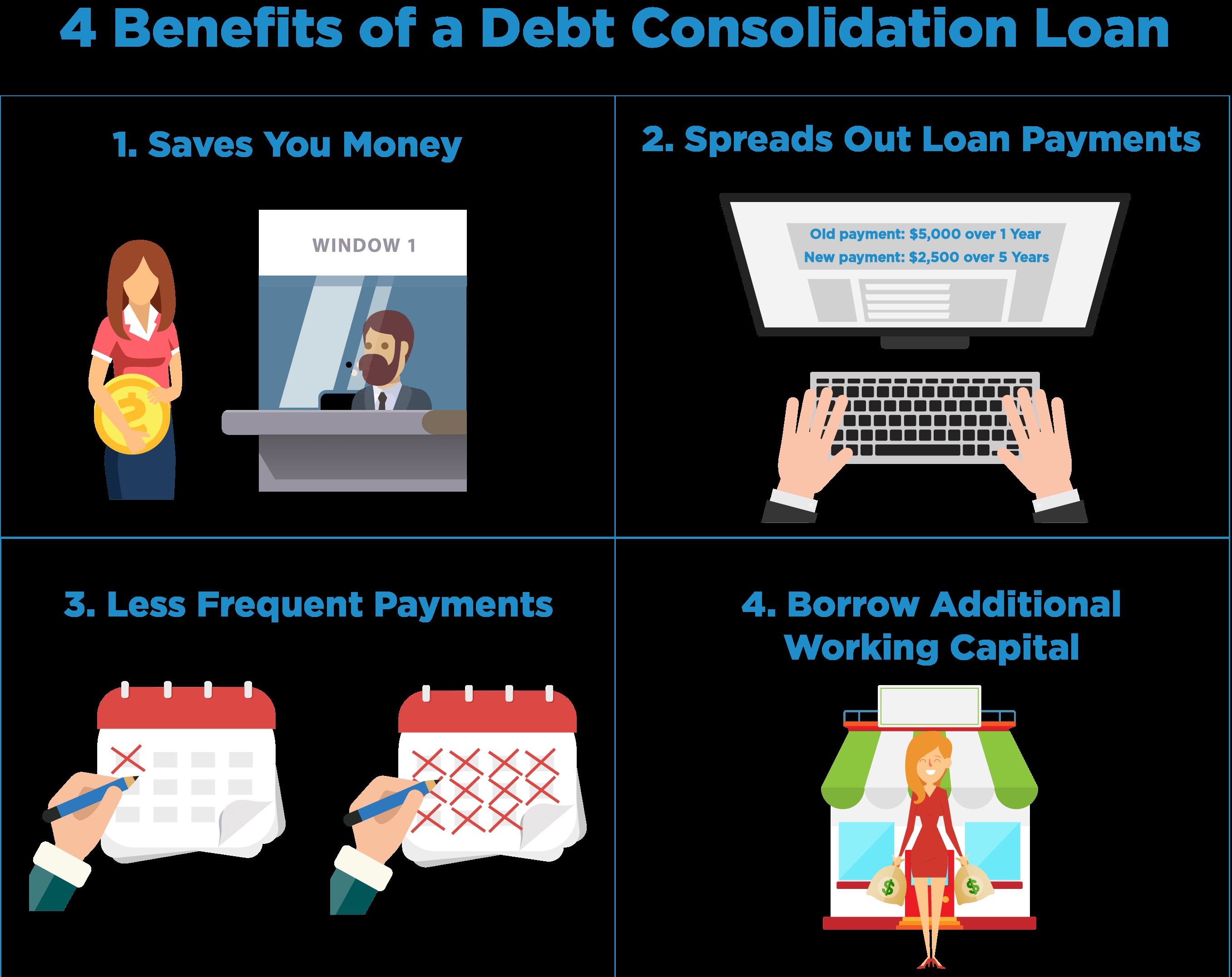

What Is Debt Debt consolidation? Financial obligation loan consolidation describes the act of getting a brand-new car loan to pay off other obligations as well as customer financial debts. Multiple debts are integrated right into a single, larger financial obligation, such as a finance, usually with even more desirable reward termsa reduced passion price, lower monthly settlement, or both.

The Greatest Guide To Federated Funding Partners

If you are burdened different kinds of debt, you can request a finance to combine those financial obligations into a single liability and also pay them off. Repayments are then made on the check brand-new financial debt until it is settled in full. Lots of people apply through their financial institution, cooperative credit union, or bank card company for a financial obligation consolidation lending as their primary step.

financial debt consolidation An important point to note is that financial obligation combination lendings do not eliminate the original financial debt. Instead, they just move a consumer's financings to a different loan provider or type of loan. For real debt alleviation or for those that do not get lendings, it may be best to explore a debt negotiation as opposed to, or in combination with, a financial debt loan consolidation funding. Customers can function with debt-relief organizations or credit scores therapy solutions. These organizations do not make real fundings yet try to renegotiate the borrower's present financial debts with creditors. To combine financial obligations and also save money, you'll need good credit history to get approved for an affordable rate of interest. Kinds Of Financial Obligation Combination There are 2 wide sorts of financial obligation consolidation lendings: safeguarded and also unsecured finances.

Getting My Federated Funding Partners Reviews To Work

The asset, in turn, functions as security for the car loan. Unsafe finances, on the other hand, are not backed by possessions as well as can Our site be extra challenging to get. They additionally often tend to have higher rate of interest and also lower certifying quantities. With either kind of car loan, rates of interest are still usually less than the rates billed on bank card.

There are a number of methods you can swelling your financial debts together by settling them right into a single settlement. Below are a few of the most common.

Credit score cards One more technique is to consolidate all your credit history card settlements into a brand-new bank card. This brand-new card can be a good idea if it charges little or no rate of interest for a collection time period. You might additionally make use of an existing charge card's equilibrium transfer featureespecially if it provides a special promotion on the transaction.

The Main Principles Of Federated Funding Partners Legit

The new rate of interest rate is the heavy average of the previous lendings. Benefits and also Downsides of Loan Consolidation Car Loans If you are considering a financial debt combination financing there are benefits as well as drawbacks to take into consideration.

Longer settlement schedules imply paying much more in the long run. If you think about debt consolidation car loans, talk to your bank card issuer(s) to find out for how long it will certainly take to repay financial debts at their existing passion rate and compare that to the potential brand-new funding. There's likewise the possible loss of special stipulations on institution debt, such as interest rate price cuts as well as other rebates. In a great deal have a peek at this website of instances, this might be made a decision by your lending institution, who might pick the order in which financial institutions are paid back. Otherwise, pay off your highest-interest financial obligation first. Nonetheless, if you have a lower-interest loan that is causing you extra emotional as well as psychological anxiety than the higher-interest ones (such an individual funding that has actually strained family relationships), you may intend to start keeping that one rather.